“The CEO of HSBC in Sri Lanka discounted the UNP threat as ‘silly… political tub-thumping.’ He said there was no way a future UNP government would voluntarily default, and was confident that international markets would be unconcerned by the UNP position. Other international bank and credit rating agency reps gave Econoff the same assessment.” the US Embassy Colombo informed Washington.

The Colombo Telegraph found the related leaked cable from the WikiLeaks database. The unclassified cable discusesSri Lanka’s debut sovereign bond issue. The cable was written by the Ambassador Robert O. Blake on September 05, 2007.

The Colombo Telegraph found the related leaked cable from the WikiLeaks database. The unclassified cable discusesSri Lanka’s debut sovereign bond issue. The cable was written by the Ambassador Robert O. Blake on September 05, 2007.

The ambassador wrote; “The Government of Sri Lanka plans to issue the country’s first international sovereign bond, in hopes of raising $ 500 million to fund infrastructure projects. However, the main opposition United National Party has announced that a future UNP government would not honor the bonds, which it claims the country cannot afford. UNP reps told us that their effort to sink the bond issue is primarily political though — an effort to keep the government from being able to buy the continued loyalty of former UNP MPs who joined the government as ministers last January. While markets will likely correctly view the UNP threat as a political move that would never materialize, the timing of the pending bond issue appears to be as bad or worse as sixteen months ago, when the government shelved an earlier plan for a $ 1 billion sovereign bond issue. Sri Lanka has had little good news to reassure currently skittish international debt markets. Nevertheless, market watchers say that the relatively small bond issue will probably appeal to a sufficient number of international investors who remain interested in diversifying their holdings of high-yielding emerging market debt.

“The Central Bank of Sri Lanka, which will float the bond on behalf of the Government, has selected JP Morgan, Barclays Capital and HSBC as joint lead managers of the issue, from among twelve local and international banks that bid on the role. According to a senior Central Banker, the bank plans an October road show to financial centers like New York, London, Frankfurt, Singapore, and Hong Kong to publicize the planned bond issue.”

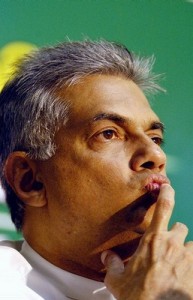

“The opposition United National Party has challenged the government’s plan to issue the bonds. UNP leader Ranil Wickremesinghe wrote to JP Morgan, Barclays, and HSBC August 24, stating that ‘the bond issue is in violation of the law’ and that the ‘a future Government formed by the United National Party will not be able to honour the repayment obligations under this bond issue.’ In the letters, Wickremesinghe charges that the government has not informed Parliament of its plans to issue the bonds; that interest payments on the bonds ‘will hamper the sustainability of Sri Lanka’s long-term programme for servicing its existing public debt repayments’; and that the bonds may contribute to corruption, since planned ‘major infrastructure projects… have all been funded by bilateral and multilateral’ lenders. Wickremesinghe sent similar letters to U.S. Securities and Exchange Commission Chairman Christopher Cox and to Cox’s UK equivalent, urging them to ‘consult with the banks concerned and bring to a halt the issuance of this sovereign bond.’” Ambassador Blake further wrote.

Read the cable below for further details;

UNCLAS SECTION 01 OF 03 COLOMBO 001218

SIPDIS

SENSITIVE

SIPDIS

STATE FOR SCA/INS AND EEB/IFD/ODF

MCC FOR S. GROFF, D. TETER, D. NASSIRY AND E. BURKE

TREASURY FOR LESLIE HULL

E.O 12958: N/A

TAGS: ECON EINV EFIN KMCA CE

SUBJECT: SRI LANKA: GOVERNMENT REVIVES SOVEREIGN BOND ISSUE PLANS;

OPPOSITION SEEKS TO BLOCK

REF: A. 06 Colombo 550 B. Colombo 170

¶1. (SBU) Summary: The Government of Sri Lanka plans to issue the

country’s first international sovereign bond, in hopes of raising

$ 500 million to fund infrastructure projects. However, the main

opposition United National Party has announced that a future UNP

government would not honor the bonds, which it claims the country

cannot afford. UNP reps told us that their effort to sink the bond

issue is primarily political though — an effort to keep the

government from being able to buy the continued loyalty of former

UNP MPs who joined the government as ministers last January. While

markets will likely correctly view the UNP threat as a political

move that would never materialize, the timing of the pending bond

issue appears to be as bad or worse as sixteen months ago, when the

government shelved an earlier plan for a $ 1 billion sovereign bond

issue. Sri Lanka has had little good news to reassure currently

skittish international debt markets. Nevertheless, market watchers

say that the relatively small bond issue will probably appeal to a

sufficient number of international investors who remain interested

in diversifying their holdings of high-yielding emerging market

debt. End Summary.

$ 500 MILLION BOND TO FUND

INFRASTRUCTURE, “SET A BENCHMARK”

———————————

¶2. (U) The Government of Sri Lanka has revived plans for the

country’s first international sovereign bond issue. The government

seeks to raise $ 500 million, or more if demand is strong. The

government says it intends to invest the cash it raises in

infrastructure projects. It also expects the bonds to provide an

interest rate benchmark for private Sri Lankan companies seeking to

borrow in international capital markets. This is the second time

the government has prepared to tap international markets for a large

bond issue (ref A). In mid-2006 the government abandoned plans to

raise $ 1 billion when advisor Citibank judged that the resumption of

civil war made the timing inopportune.

¶3. (SBU) The Central Bank of Sri Lanka, which will float the bond on

behalf of the Government, has selected JP Morgan, Barclays Capital

and HSBC as joint lead managers of the issue, from among twelve

local and international banks that bid on the role. According to a

senior Central Banker, the bank plans an October road show to

financial centers like New York, London, Frankfurt, Singapore, and

Hong Kong to publicize the planned bond issue.

OPPOSITION SEEKS TO BLOCK THE BOND ISSUE

—————————————-

¶4. (U) The opposition United National Party has challenged the

government’s plan to issue the bonds. UNP leader Ranil

Wickremesinghe wrote to JP Morgan, Barclays, and HSBC August 24,

stating that “the bond issue is in violation of the law” and that

the “a future Government formed by the United National Party will

not be able to honour the repayment obligations under this bond

issue.” In the letters, Wickremesinghe charges that the government

has not informed Parliament of its plans to issue the bonds; that

interest payments on the bonds “will hamper the sustainability of

Sri Lanka’s long-term programme for servicing its existing public

debt repayments”; and that the bonds may contribute to corruption,

since planned “major infrastructure projects… have all been funded

by bilateral and multilateral” lenders. Wickremesinghe sent similar

letters to U.S. Securities and Exchange Commission Chairman

Christopher Cox and to Cox’s UK equivalent, urging them to “consult

with the banks concerned and bring to a halt the issuance of this

sovereign bond.”

¶5. (SBU) A UNP economic advisor told Econoff, however, that if given

the opportunity to do so in a future government, the party does not

COLOMBO 00001218 002 OF 003

in fact intend to default on the bonds. The move, he said, is

rather a political tactic in the UNP’s strategy to bring down the

Rajapaksa government. The UNP believes that, if it can block the

bond issue, it will be able to lure back former UNP members of

parliament who joined the Rajapaksa government as ministers in

January (ref B). Conversely, the UNP believes that if the bond goes

through, the government will be able to buy the continued support of

those MPs by allocating much of the cash to the ministries they

control. The advisor stuck with the UNP’s charge that the bond

issue would violate the law, saying that it would cause the

government’s total outstanding debt to exceed a maximum established

by Parliament. One of the UNP ministers who joined the SLFP in

January likewise told Ambassador that the UNP had made, but not

followed through on, a similar threat to block the partial

privatization of the national airline in the 1990s.

¶6. (SBU) The CEO of HSBC in Sri Lanka discounted the UNP threat as

“silly… political tub-thumping.” He said there was no way a

future UNP government would voluntarily default, and was confident

that international markets would be unconcerned by the UNP position.

Other international bank and credit rating agency reps gave Econoff

the same assessment. (The Colombo-based JP Morgan representative

told Econoff he could not comment on the impact of the UNP’s letter

to JP Morgan while his firm conducted due diligence preparations for

the bond issue.)

¶7. (SBU) As for the government’s legal right to proceed with the

bonds, the senior Central Banker told Econoff that in fact the

government had notified Parliament, in its November 2006 budget

proposal for 2007, that it planned “foreign borrowings up to one

billion dollars.” Finance Ministry and Central Bank officials told

EconFSN that Foreign Loans are covered under Sri Lanka’s Foreign

Loans Act and therefore do not need special parliamentary approval

and that debt levels under the Fiscal Management Responsibility Act

are only targets to improve transparency and accountability, not

binding limits.

S&P SAYS SRI LANKA CREDIT OUTLOOK “STABLE”

——————————————

¶8. (U) On August 9, Standard & Poor’s Ratings Services upgraded its

outlook on Sri Lanka’s credit ratings from “negative” to “stable.”

(According to S&P, a negative outlook is used to signal that the

rating may be lowered in the near future, whereas stable signals the

rating is unlikely to change.) S&P kept Sri Lanka’s long-term

foreign currency rating unchanged at B+, or four tiers below

investment grade. S&P attributed the improved outlook to “higher

tax collections, strengthening of fiscal and macroeconomic

coordination, elimination of fuel subsidies and revision of

electricity prices” and “the limited impact on the economy from the

renewed fighting.”

¶9. (SBU) The senior Central Banker told Econoff that JP Morgan had

been influential in the S&P outlook decision, both by helping the

Bank prepare for the S&P assessment and by convincing S&P during its

deliberations that the Sri Lankan economy was in fact holding

stable. According to the Central Banker, Citibank had not been as

helpful in preparing the bank for the April 2007 Fitch Ratings

assessment, which ended with Fitch keeping its outlook at

“negative.” The new local Citibank head acknowledged to Econoff

that JP Morgan had beaten Citibank on “customer service,” but

maintained that Citi would have been a better choice than JP Morgan,

Barclay’s or HSBC to lead the bond issue.

COMMENT: POLITICS ASIDE, TIMING FAR FROM OPTIMAL

——————————————— —

¶10. (SBU) Aside from its political agenda, the opposition seeks to

block this bond issue because it doubts the government will

COLOMBO 00001218 003 OF 003

productively invest the proceeds in infrastructure projects. This

is a valid concern on three levels. First, as the opposition fears,

the government may well use the funds to retain the loyalty of

ex-UNP ministers by permitting them to pursue pork-barrel projects.

Second, the government has said it intends to build infrastructure

even where there is not currently a market demand (like the

Weerawila airport), or which could be built more efficiently by the

private sector (like an expanded oil refinery at Sapagaskunda).

Third, the government is showing signs of being short on cash to

bridge an apparently growing fiscal deficit, so it will likely use

some of the bond funds for current, rather than capital,

expenditures.

¶11. (SBU) While markets will likely correctly view the UNP threat as

a political move that would never materialize, the timing of the

pending bond issue appears to be as bad or worse as sixteen months

ago, when the government shelved its earlier sovereign bond issue

plan. Aside from the S&P outlook returning to stable, Sri Lanka has

had little good news to reassure currently skittish international

debt markets. Nevertheless, market watchers say that the relatively

small bond issue will probably appeal to a sufficient number of

international investors who remain interested in diversifying their

holdings of high-yielding emerging market debt.

BLAKE