By Aruna Kulatunga –

Aruna Kulatunga

Lankans loose Rs. ten,000 per person due to looses incurred under Cabraal

It was in 1992 that I returned to Sri Lanka from Hong Kong to start Forbes Analysis, one particular of the 1st independent equity research homes in Sri Lanka. In the course of my two year stint with Forbes Research, before leaving to Hong Kong once more to take up an offer you with 1 of Asia´s best stock broking firms, Credit Lyonnais Securities Asia (CLSA) as their institutional sales head for the Indian sub-continent primarily based in HK, I was a member of the USAID-ISTI principal debt committee that created a series of suggestions which laid the foundation for the modify of what was previously identified as rupee loans to treasury bonds.

This background left me in some consternation when I read the report of the committee appointed by the government to appear into the Bond issues of the Central Bank final week. Prior to I delve far more, I have recognized Central Bank governor since his days as a young advisor to the then Minister of Industries Mr Ranil Wickremesinghe in the early 90´s, and have worked in parallel whilst he was head of study for Society Generale Cross Asset Investigation ( Soc-Gen Crosby) and I was at Credit Lyonnais. I have been in regular speak to considering that 2012 with Charlie Mahendra, a contemporary of my father at the University of Peradeniya and his neighbour at the Ramachandra Hall and an advisor to the Prime Minister Mr Ranil Wickremesinghe. The senior Mr Mahendra tolerated my chatter during the time we each visited the workplace of the leader of the opposition since 2012. When the very first indications of the Bond problem becoming an situation became apparent through a Facebook post, I was amongst the very first to defend Arjuna Mahendra – not because I had information of him, but also due to the fact it created no sense – and still does not.

Lets take the events and construct a timeline taking from the Committee report.

Lets take the events and construct a timeline taking from the Committee report.

01-Feb-15

The Public Debt Department (PDD) of the Central Bank in consultation with other folks estimates the debt requirement for the subsequent month – in this case for month beginning 01 March 2015. No evidence has been presented as to what this amount was

20-Feb-15

DG of Treasury Operations sends a letter to PDD stating the borrowing requirement to be Rs. 13.55 billion. (The report erroneously states this quantity to be Rs Thirteen point five hundred and fifty billion. It must study alternatively Rs. Thirteen billion and five Hundred Fifty Million. The report also states that “in terms of the document referred to the entirety of the funding has to be through treasury bonds.”

23-Feb-15

The monetary board, where the Central Bank governor is also a member decides to situation a 30 year treasury bond to re-profile the debt service profile of the country “as there is good interest shown by foreign investors”. The Board had already decided to do away with the approach of direct placements followed just before the adjust of government and to raise funds by means of direct bond auctions.

The board does not repair the quantity that needs to be raised, as that is a function that is vested with the PDD. Two pertinent comments are in the Board paper (MB/ER/four/2/2015):1.) That the board disagreed with the reduce in policy prices as suggested by the MPC as ” is NOT acceptable at this stage, given the increasing trend of industry interest rates and increasing development of private sector credit” even though deciding to sustain rates at the current level and that it was of the view “that issuing 30 year treasury bonds would be favourable at this stage to extend the yield curve and re-profile the debt service”, clearly indicating that board considered the policy prices to be the short-term rates and the 30 year bond price as a separate concern altogether that wants to be addressed differently.

PDD publishes the advertisement calling for bids for a 30-year bond for a total of Rs 1 Billion. PDD indicates (not in the advertisement, but in verbal communication with the major dealers that the indicated yield will be around 9.25%, as is the normal practice followed prior to the modify of government

27-Feb-15

The bidding for the Bond of the series quantity LKB03045C013 opens at 1000hrs.

27-Feb-15

The governor of the central bank, accompanied by two deputy governors is present close to the PDD dealing space from 1030hrs till 1056hrs. This data is not in the report but has been gleaned from other reports publicly obtainable and not denied by the Governor or the two deputy governors.

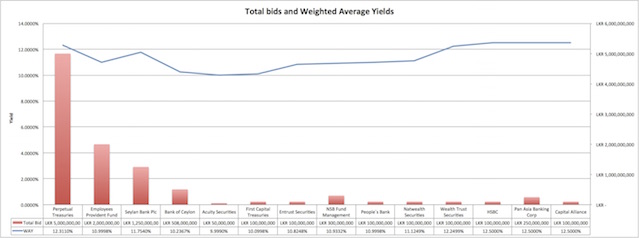

The governor and the two deputy governors leave the region at 1056hrs. By this time, practically 24 bids had come in, which includes two from Perpetual Securities. The largest bids up to this time came from EPF, (Rs. 1,000,000,000 at Yield net of Tax (YNT) of ten.9998% and Seylan Bank (Rs. 1,250,000,000) at YNT of 11.754%. The two bids from Perpetual, at equal amounts of Rs 250,000,000 each have been at an YNT slightly decrease than Seylan at 11.55 and 11.75%. The initial funding requirement of Rs 1 billion had been satisfied by this time.

Immediately following the Governor left the dealing space with his two deputies, within the period of 4 minutes from 1056hrs till 1100hrs when the auction officially closed, Perpetual made four additional bids, 1 at a YNT of 11.997, another at other at 12.24, the third at 12.75 and the fourth at 12.99. All of these bids, for 13 billion rupees were made by Bank of Ceylon on behalf of Perpetual.

Two additional notable bids came in soon after 1056hrs. 1 was the bid created by Bank of Ceylon for Rs. 3 billion at the highest YNT of 12.5009 and one more that came in seconds following the bids closed, but accepted by the Tender board from HSBC bank for Rs. one hundred,000,000 at a YNT of 12.5

27-Feb-15

The treasury Bond Tender committee meets at 12:30 pm (the meeting continued till 13:10pm) and decides to accept Rs. 10,058 million at a weighted typical yield (WAY) of 11.73%. The governor did not participate in this meeting according to the minute paper. Following the tender committee choice, the Public debt Department of the Central Bank released a press release providing particulars of the Auction, offering the coupon price of 12.50%, the quantity accepted and the weighted typical yield.

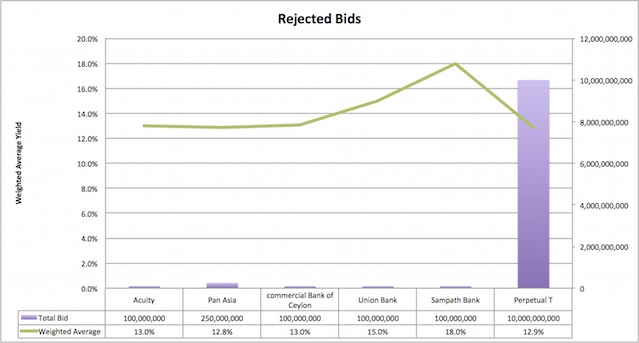

36 bids have been received of which only 26 bids were accepted and ten rejected. Amongst these ten rejected bids were two bids amounting to Rs 10 billion by Perpetual made by way of Bank of Ceylon at a WAY of 12.9% and curious bid by Sampath bank for Rs. 100,000,000 at a WAY of 18%. Acuity, whose name was described by Perpetual CEO to the committee, saying he also wanted to bid through Acuity but was unable to do so as an Acuity director could not be positioned, also created a failed bid for Rs. one hundred,000,00 at a WAY of 13%.

Here are the bullet points from the timeline

The industry was aware of the government´s borrowing requirement from the 20th of February, the date on which the Finance ministry director basic of Treasury Operations sends a letter to Public Debt division indicating the quantity to be raised as Rs 13 Billion and apparently indicating that the entirety of the funding has to be by way of the treasury bonds.

The industry was conscious that the monetary board decided to problem a 30-year Treasury bond to extend the yield curve and re-profile the debt service as of the 23rd of February.

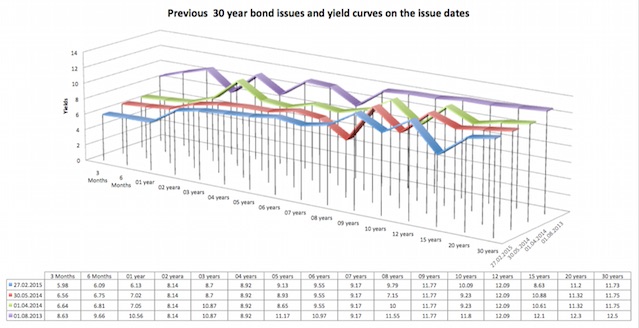

The marketplace is conscious that the yield curves for the previous four 30 year bond troubles are reasonably related and was issued at related debt service profiles. (See illustration – “Previous 30 year bond problems and yield curves on the concern dates “).

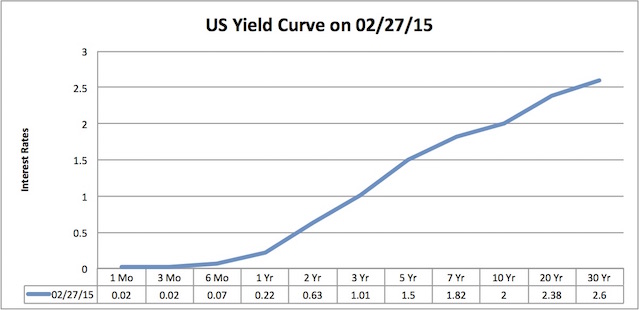

They had been all issued around a WAY of 11.75 with the differential among the brief term prices to the 30 year bond was between 31% to 44%. In comparison, the differential of the 30-year US bond price to the 3 month US T-bill rate on 27th February 2015 was over 130 times. (See illustration – “US yield curve on 27/02/2015”)

They had been all issued around a WAY of 11.75 with the differential among the brief term prices to the 30 year bond was between 31% to 44%. In comparison, the differential of the 30-year US bond price to the 3 month US T-bill rate on 27th February 2015 was over 130 times. (See illustration – “US yield curve on 27/02/2015”)

A brief explanation of the yield curves may possibly be necessary right here. The yield curves of brief to long term treasury bills and bonds basically reflect the confidence level of investors of the country’s growth prospects and the danger the investors are willing to take in giving their funds for longer periods of time. The danger profile of a 30-year bond is obviously a lot larger than that of a 3 month Treasury bill and consequently investors do demand a larger premium or interest price to give their income for a 30-year period. If a yield curve is flat or is trending downwards – which means the longer-term prices are decrease than the quick rates, that indicates an economy that is entering into a deflationary period and there will be no demand for the longer-term instruments. The current European economic crisis, specially in the economies of Greece and Spain, are excellent examples where the yield curve reversed and there had been no buyers for the lengthy-term instruments.

A brief explanation of the yield curves may possibly be necessary right here. The yield curves of brief to long term treasury bills and bonds basically reflect the confidence level of investors of the country’s growth prospects and the danger the investors are willing to take in giving their funds for longer periods of time. The danger profile of a 30-year bond is obviously a lot larger than that of a 3 month Treasury bill and consequently investors do demand a larger premium or interest price to give their income for a 30-year period. If a yield curve is flat or is trending downwards – which means the longer-term prices are decrease than the quick rates, that indicates an economy that is entering into a deflationary period and there will be no demand for the longer-term instruments. The current European economic crisis, specially in the economies of Greece and Spain, are excellent examples where the yield curve reversed and there had been no buyers for the lengthy-term instruments.

The end February US yield curve and the healthy appetite shown by investors for US 30 year bonds is one particular of the causes why economists think the US has turned strongly about and is today back in the saddle as the world´s strongest economy.

Any affordable investor, obtaining in hand the data that the government needed a considerable quantity of funds to spend off the debts incurred by the prior regime, that the monetary board intended to extend the yield curve employing the 30 year bond and obtaining access to market place rates of earlier concerns and existing bond prices can make a affordable guess as to where the yield will be. It was not only Perpetual who created this affordable guess – Wealth Trust Securities, HSBC, Pan Asia Banking Corp and Capital Alliance all bid at a weighted typical larger than 11.73% with HSBC, Pan Asia and Capital alliance all coming in at 12.5%, slightly greater than the 12.311% WAY that Perpetual received for their accepted bids. There have been unreasonable assumptions also – for example that curious 18% bid from Sampath Bank. Other folks whose bids failed to make the cut-off point, in addition to the Rs ten billion that Perpetual created unsuccessfully, consists of Acuity, Pan Asia, Industrial Bank and Union Bank, who all bid above 12.five%. (See illustrations “Total bids and weighted Typical Yields” and “Rejected bids”).

There is a vital assumption that I am producing right here – and that is what needs considerably far more scrutiny. I am making the assumption – primarily based on info gleaned from numerous sources – that the market place players have been fully conscious of two pieces of confidential info before the bidding began on the 27th – that is that the government needed far more funds and that the monetary board had expressed a sentiment that the 30 year bond concern will be used to re-profile the debt profile and extend the yield-curve. It is no secret amongst the main dealers and the top financiers of the country of the incestuous relationships amongst the dealer desks of the main dealers and that of the Public Debt department. Jobs are provided to kith and kin of senior central bank workers by primary dealers to propagate these relationships and there has been a totally free-flow of data between dealer desks for decades. Perpetual is 1 of these principal dealers who had access to confidential details since its inception, long prior to Arjuna Mahendran, whose son-in-law created and launched Perpetual Treasuries, became the Governor. A big quantity of the somewhat “controversial” private placements or direct placements that the Pitipana Committee alludes to in the Bond situation report, have been placed via Perpetual by the earlier regime.

There is a vital assumption that I am producing right here – and that is what needs considerably far more scrutiny. I am making the assumption – primarily based on info gleaned from numerous sources – that the market place players have been fully conscious of two pieces of confidential info before the bidding began on the 27th – that is that the government needed far more funds and that the monetary board had expressed a sentiment that the 30 year bond concern will be used to re-profile the debt profile and extend the yield-curve. It is no secret amongst the main dealers and the top financiers of the country of the incestuous relationships amongst the dealer desks of the main dealers and that of the Public Debt department. Jobs are provided to kith and kin of senior central bank workers by primary dealers to propagate these relationships and there has been a totally free-flow of data between dealer desks for decades. Perpetual is 1 of these principal dealers who had access to confidential details since its inception, long prior to Arjuna Mahendran, whose son-in-law created and launched Perpetual Treasuries, became the Governor. A big quantity of the somewhat “controversial” private placements or direct placements that the Pitipana Committee alludes to in the Bond situation report, have been placed via Perpetual by the earlier regime.

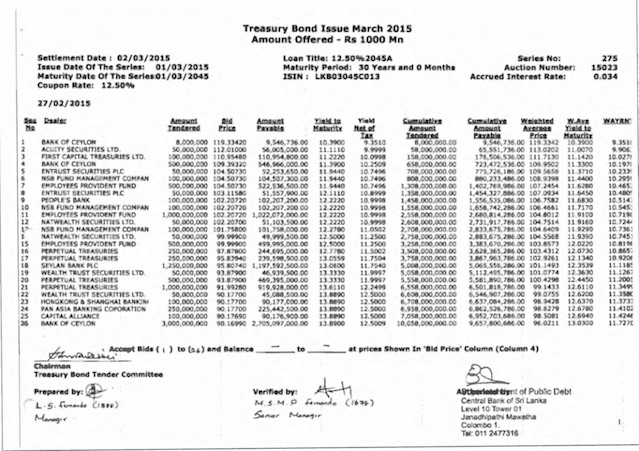

As the committee itself observes, the very truth that a confidential internal document, the accepted bids list, ready by Mr L.S. Fernando, employee Number 1888 of the Public Debt Department and verified by Mr M.S.M.P. Fernando, employee quantity 1678 of the identical department, was obtainable on the world wide web not even 24 hours soon after the auction, testifies to the sieve like nature of the PDD. (See illustration “bids acceptance sheet for 27/02 auction”)

As the timeline shows, what is curious is that the massive bids from Perpetual and the other high yield bids came following the Governor and the two deputies left the tender committee area. As the committee observes, there is no digital footprint available either at the PDD or of the senior Central Bank officials. It would however be trivial to get the Governor´s phone records to clarify whether or not or not the governor did make any calls to his son-in-law or any other connected individual after he left the dealing area and prior to the bids came in.

As the timeline shows, what is curious is that the massive bids from Perpetual and the other high yield bids came following the Governor and the two deputies left the tender committee area. As the committee observes, there is no digital footprint available either at the PDD or of the senior Central Bank officials. It would however be trivial to get the Governor´s phone records to clarify whether or not or not the governor did make any calls to his son-in-law or any other connected individual after he left the dealing area and prior to the bids came in.

On the other hand, one particular could also question as to why 4 other major dealers, such as the late bid from HSBC, bid at a larger yield following ten:56am. Did all of these get a telephone get in touch with from the Governor? Or was there yet another “communicator” inside the PDD that relayed the details that there nonetheless was a gap in the cash required – due to the fact even though the PDD decided to accept bids up to Rs ten,058 million, only at 12:15pm, it would not be incorrect to assume that by 10:56am, there was a general agreement on the final numbers, given the Treasury borrowing requirements of the 20th and the Monetary Board choices of the 23rd, the same numbers that the industry had also. Nevertheless, the massively aggressive bidding by Perpetual, made by way of Bank of Ceylon for a total of Rs 13 billion, coming after the crucial time of 10:56am also tells a diverse story. Perpetual created 4 bids on their own, for a total of Rs two billion, for a WAY of much less than 12% before the deluge came by means of Bank of Ceylon. These four bids are on par along with the other bids that had been received by that time. Others such as the EPF and Seylan Bank made equivalent bids (even though EPF bid low, getting their allocation for a WAY of ten.99% – possibly fund managers at EPF had been not able to make best use of market place data.)

This brings us to yet another critical element of the puzzle. Other than for EPF, and possibly Seylan Bank, none of the other principal dealers would have been bidding for their personal account. Definitely, Perpetual will not have the capital of Rs 15 billion in total to invest in a bond. Main dealers typically locate a client, typically an investment fund or insurance business, and then bids on the client´s behalf. Banks, like Bank of Ceylon, extends margin calls to primary dealers and their consumers. Offered the sovereign status of Central Bank bonds and Treasury bills, such margins are provided at minimum rates and minimum fuss. The Bank of Ceylon dealer is on record on the committee report that he was under the impression the finish client for the Rs 13 billion order from Perpetual was an insurance organization. Perpetual CEO has denied that he disclosed the finish client.

A source from Bank of Ceylon indicated to me that Perpetual had been quick-selling both equities (which is illegal and is not possible under the present CDS guidelines) and debt, which is attainable beneath repurchase or REPO agreements, in the week ahead of the 27th auction. There was a differential between the 30-year bond and the brief-term instruments – but unless one is incredibly aggressive, one would not take the threat of a value miss-match between the short and lengthy-term instruments.

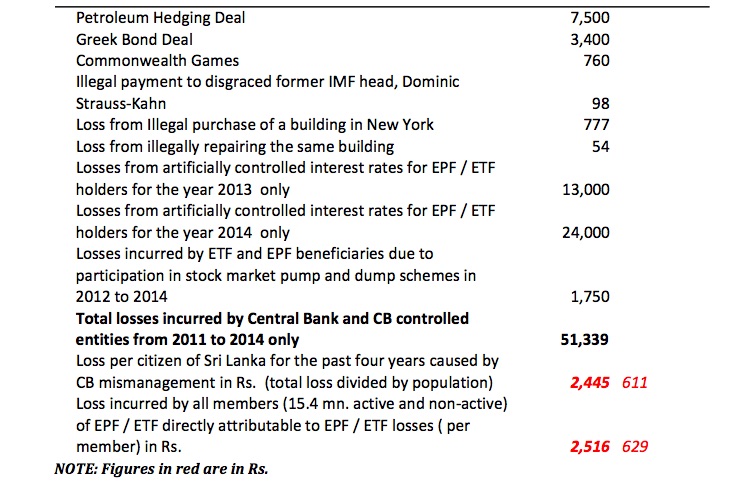

Along with this mismatch of data came the completely contradictory statements by former minister Bandula Gunawardane and the former governor Ajith Nivard Cabraal with regards to the so named losses incurred due to the Bond getting placed at a larger yield. Whilst Mr Gunawardane is on record saying this is as high as Rs million 59,000, Mr Cabraal areas the loss at Rs. Million eight,000.

A detailed calculation made by independent and respected study firm Verite has now proved beyond doubt the veracity of these claims, so significantly so that both Mr Gunawardane and Mr Nivard has stopped mentioning losses. Even the so named “interim draft report of the COPE investigation” refers only to an “opportunity cost” of Rs 526 million, significantly less than one particular per cent of the Rs million 59,000 that former Minister Gunawardane claims to be the loss. (Web page 11, section 17.B).

The Verite study calculation, that has now been analysed and accepted by a number of competent analysts states that Mr Gunawardane and Mr Cabraal just did not know how to calculate a value of a bond. They pointed to 3 main errors:

- A computational error on the time-worth of cash,

- An inaccurate stipulation of the base-price and

- A weak assumption with regard to market place effect and ‘loss’.

According to Verite estimates, the only impact the selection to boost the quantity from Rs million 1,000 to Rs million 10,000 was an enhanced interest burden of Rs. 896 million, over a 30 year period, or an interest burden of less than Rs 29 million each year, approximately the same quantity former President Mahinda Rajapaksa spent per day for the upkeep of his private fiefdom. Other analysts have pointed out that this is not a loss, as this improved interest burden really gets paid back to captive central bank controlled state institutions such as the EPF, ETF and Bank of Ceylon, who were the finish clientele of the principal dealers, ensuring that cash is captured in a loop amongst Central Bank and state institutions.

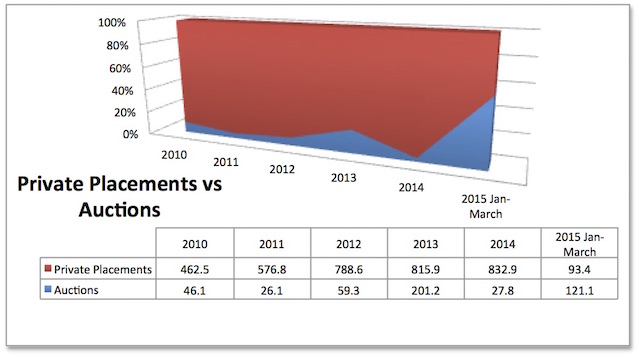

Each the COPE report and other reports allude to the apparent disregard of the former Central Bank governor to stick to established patterns in placing bonds and treasury bills. The suggestions clearly printed in the PDD manual (COPE report, Web page six, section 5, paragraph four) says that as significantly as feasible, debt should be raised by means of auctions. This is the established practice in all-significant economies in the globe and ensures transparency and industry prices for investors. On the contrary, the former governor decided to adjust the system in favour of direct or private placements to explicitly fix the interest rates as per the observations in the COPE report (page 06, section 05 and page 10, section 14). The COPE report also notes that there is basically no transparency in this method of raising debts. (Ibid. page 10, section 14).

Details now accessible by way of the Central Bank (created obtainable to the COPE committee) tells of the enormity of this very opaque method that reeks of favouritism and achievable corruption. Under this strategy, a handful of favoured primary dealers had been provided the chance of quoting on behalf of the captive institutions. The modus operandi adapted by the pre-09 Jan 2015 Central bank was to auction a pittance of bonds and treasury bills and then make a round of calls to captive institutions to force them to get at 500 basis points or half a per cent reduce than the price fixed by way of the auction. These transactions then had been executed by way of just a couple of favoured dealers. (See Private placements vs. auctions).

In 2014 alone, only 3.two% of Rs million 860,700 or as little as Rs million 27,800 out of the Rs. Million 860,700 was auctioned. The rest, Rs million 832,900 was privately placed.

In 2014 alone, only 3.two% of Rs million 860,700 or as little as Rs million 27,800 out of the Rs. Million 860,700 was auctioned. The rest, Rs million 832,900 was privately placed.

The 500 basis point “discount” means that ETF, EPF and other captive institutions like the Insurance coverage corporation and Bank of Ceylon gets less for the monies they invest and in turn beneficiaries of those institutions, i.e. ETF and EPF beneficiaries earn less on their deposits.

Central Bank calculates that the loss for the ETF and EPF alone simply because of this controlled interest rate regime was Rs. Million 13,000 in 2013 and Rs. Million 24,000 in 2014.

As the table below shows, every Sri Lankan citizen lost a staggering Rs 2,445 rupees in the course of the previous 4 years in total due to mismanagement and fraud at the Central Bank below the watch of the former governor. EPF and ETF holders alone, the operating population of this nation, lost Rs 2,516 per beneficiary in those four years or Rs 629 per beneficiary every single year. If EPF had invested this Rs. two,516 in the February 27, 30 year bond problem at an interest rate of 12.5%, employing the erroneous approach of calculation used by former minister Bandula Gunawardane, every single member would earn Rs 9,435 in interest alone at the end of that 30 years, with no compounding the interest.

Central Bank losses and frauds from 2011 to end 2014 in Rs. Millions

When one particular speaks with the primary dealer neighborhood in Colombo, one particular gets a sturdy impression that the incestuous relationships that the current opposition alleges against the current governor, Arjuna Mahendran, are not unique, but endemic in the community. For instance, its now established that former governor´s sister served for more than 3 years as a director of the holding firm of Perpetual Treasuries.

When one particular speaks with the primary dealer neighborhood in Colombo, one particular gets a sturdy impression that the incestuous relationships that the current opposition alleges against the current governor, Arjuna Mahendran, are not unique, but endemic in the community. For instance, its now established that former governor´s sister served for more than 3 years as a director of the holding firm of Perpetual Treasuries.

Another director of the business, Ranjan Hulugalle is allegedly closely connected with Anura Fernando, a effectively known figure in the monetary circles and a former companion of the former governor Cabraal when Cabraal family held equity in the multi-level advertising scheme connected with Malaysian high profile investor Vijay Eswaran.

Over the years, several allegations have been created against Mr Fernando concerning the proprieties of his bargains, but not much has been proven. Allegedly Mr Fernando was closely linked to the controversial deal in 2012 when the National Savings Bank, beneath the watch of its former chairman Pradeep Kariyawasam, purchased the The Finance Firm (TFC) in what appeared to be a classic pump and dump action. The previous government was forced to cancel and reverse the deal.

Major dealers claim that Perpetual showed an extraordinary growth since its start in 2013. For instance, their dealer license had been granted in just two months ‘time when most had to wait for more than two years. Whilst Perpetual did not show significantly wins in the auctions, dealers allege that they did have a steady flow of income as the lead dealer for ETF and EPF in the primary income markets exactly where most deals (96% in 2014) were done in the opaque and paper-trail-much less direct placement market place.

The government of Mr Ranil Wickremesinghe has promised a by way of investigation in to no matter whether or not Perpetual created use of inside details and if so, as to who are culpable. In a recent interview, Mr Wickremesinghe said that he would be appointing choose committee if his government returns to energy post- august 17 and that he will appoint an opposition member to head that committee.

The Aegean stables that Mr Wickremesinghe inherited on Jan 09th of this year are not just messy, smelly, intricate and hides not 1 but numerous monsters, it demands a herculean effort to clean.